According to the Department of Employment and Social Development in Canada, the salary in Ontario is “among the highest” in its category of occupations in support of healthcare workers from across Canada.

Having said that, the salary varies depending upon where you work.

This is the single most deciding factor of how much you can earn as a PSW.

These are the three primary settings where PSWs work:

- Hospitals (about 7%),

- Long-Term Care (about 57%), and

- Community (about 36%)

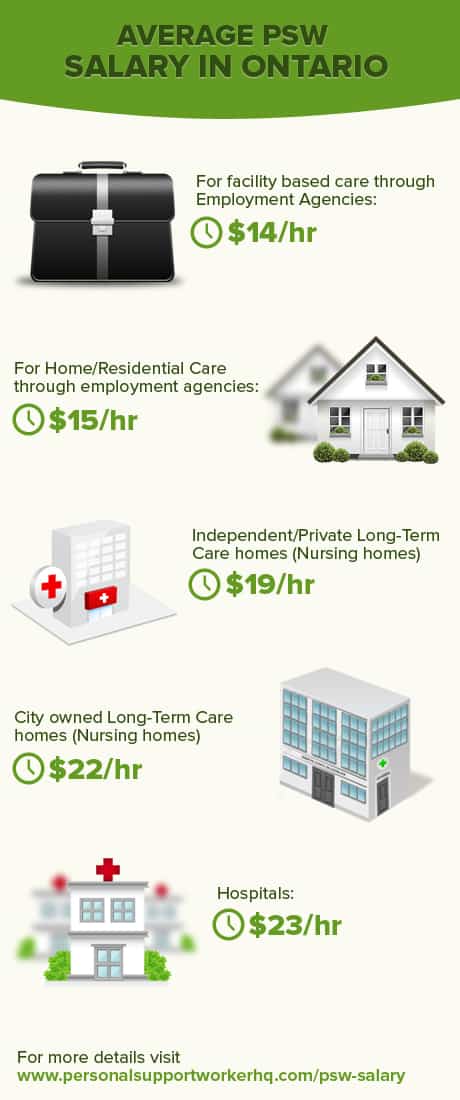

In general, hospitals in Ontario are the highest paying followed by City-owned Long-Term Care homes.

Check out the following infographic

There are other factors too that might affect your salary.

However, they might not have as much of an impact on how much you get paid:

- Experience

- Location (City)

- Continuing education

- Certain skills that are required by the employer

- Ability to speak read and write another language

COVID-19 PAY ENHANCEMENT

March 18, 2021: The Ontario Government announced an extension of the $3 temporary bonus for PSWs working in publicly funded organizations such as:

- long-term care homes,

- hospitals,

- group homes, and

- some home care settings.

The $3 enhancement is effective until June 30th, 2021.

SALARY ENHANCEMENT

The Ministry of Health and Long-Term Care announced in April 2014, a “PSW Wage Enhancement Initiative” as part of the PSW Workforce Stabilization Strategy.

The purpose of this enhancement initiative was to set up an increase by up to $4 per hour over three years.

This salary increase, however, applies only to Personal Support Workers who work in the community and provide “publically funded” personal support services.

With this increase, as of April 01, 2016, all PSWs providing services that are publically funded must be getting a minimum of $16.50 per hour.

WHAT ARE PUBLICALLY FUNDED PSW SERVICES?

In Ontario, Ministry of Health and Long-Term Care provide local health services through the Local Health Integration Networks (LHINs).

When someone needs care in the community, LHINs determine if the type of care required is eligible for government-funded services.

If it is, LHINs Case Managers, also called Integrated Care Coordinators, liaise with providers (agencies) to arrange for PSWs to provide such care.

It is this care that you provide qualifies as “publically funded” and warrants a minimum of $16.50 from your employing agency.

If you work in the following settings and your Personal Support Services are funded by LHIN, you qualify for a base rate of $16.50:

- Adult day programs,

- Overnight respite, and

- Provide services as part of the Centre of Independent Living in Toronto.

THE TIMELINE

Government’s PSW enhancement directive aimed to bring minimum of PSWs providing publically funded personal support services in the community to $16.50 by April 01, 2016.

DID YOU GET THE RAISE?

As per the Ministry of Health and Long-Term Care, 95% of employers (agencies) that hire PSWs for providing publically funded home care services, followed ministry directives.

The remaining 5% of agencies did not give PSWs the raise as mandated by the ministry.

The ministry is aware of these employers and is taking steps to bring them into compliance.

If you’re not getting the base hourly rate from your employer and believe you’re eligible for the increase, you have the right to speak to your employer to determine your eligibility.

ELIGIBLE PERSONAL SUPPORT SERVICES?

The $1.00 enhancement on top of the base pay of $16.50 per hour applies only to PSWs providing publically funded Personal Support Services.

As per the Home Care and Community Services act, 1994, following are considered Personal Support Services:

1. Personal hygiene activities.

2. Routine personal activities of daily living (ADL’s).

3. Assisting a person with any of the personal hygiene activities or ADL’s.

4. Training a person to carry out or assist with any of the personal hygiene activities or ADL’s.

5. Providing prescribed equipment, supplies or other goods.

6. Services prescribed as personal support services.

Any of the work you do in the community that is not direct care is not eligible for the $1.00 enhancement.

As per the Home Care and Community Services act, 1994, following are not considered Personal Support Services:

1. Housecleaning

2. Doing laundry

3. Ironing

4. Mending

5. Shopping

6. Banking

7. Paying bills

8. Planning menus

9. Preparing meals

10. Caring for children

11. Assisting a person with any of the activities mentioned above

12. Training a person to carry out or assist with any of the activities mentioned above

13. Providing prescribed equipment, supplies or other goods.

14. Services prescribed as homemaking services

DID YOU NOT GET THE ENHANCEMENT?

There might be two scenarios under which you’ve not been given an enhancement to the $16.50 base pay, despite the fact that the care you provide is publically funded.

EMPLOYER PARTICIPATION

One of the reason could be that your employer did not participate in Government’s PSW enhancement program.

In this case, there is nothing much you can do.

It was your employer’s decision to not participate and accept the funding to provide you a enhancement.

You can question your employer though.

NON-COMPLIANCE

Other reason could be that your employer is non-compliant with government’s directives.

You see, agencies that participated in the enhancement program were to provide a “Certificate of Compliance” to the Ministry through the LIHN they are associated with.

The deadline to provide this certificate was August 15, 2016.

You have the right to question your employer on this as well.

PSWs THAT ARE NOT ELIGIBLE FOR THIS RAISE

Please note that the enhancement initiative is only for PSWs working in the community (that provide LHIN funded care) and does not apply to PSWs working in:

- hospitals,

- long-term care homes, or

- providing private care in the community.

PSWs providing services that are not “Personal Support Services” are also not eligible for the raise.

Some examples of non-Personal Support Services are:

- Homemaking,

- Grocery shopping.

- Companionship, and

- Light housekeeping etc.

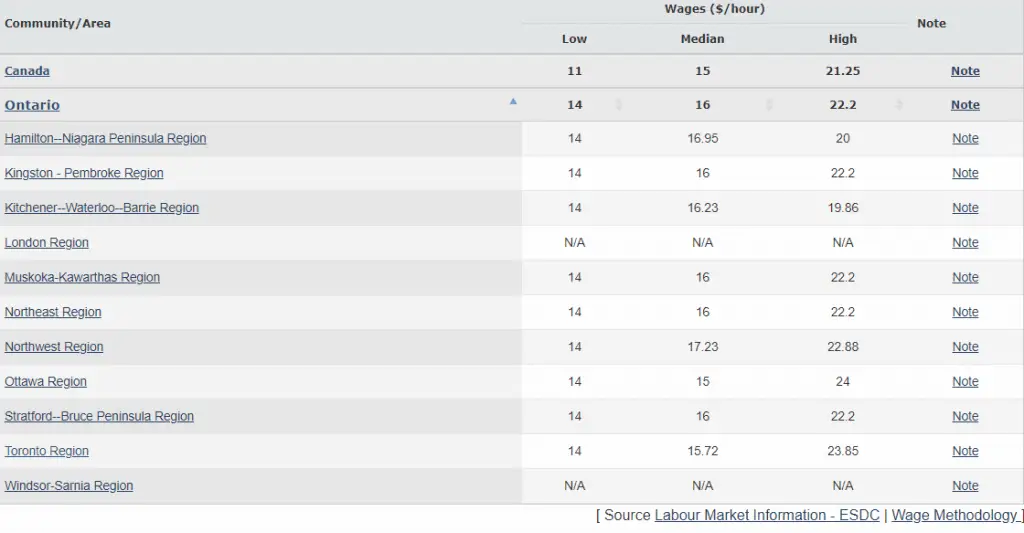

PSW PAY RATE BY REGION

Ontario is the second largest province in Canada and is the most populated.

It is divided into many regions including the vast north and the densely populated south.

PSWs provide services in every nook and corner of Ontario in the form of community care or care in facility-based settings.

In the community, it depends on the requirements of the job, work conditions, type of care needed, location and the availability.

The market report for Personal Support Workers, a comprehensive analysis by the Government of Ontario, provides a breakdown in different regions of Ontario.

Check out the details below:

You see, Ontario Healthcare system is stressed by the rising healthcare costs.

To prevent the situation from worsening further, Ontario Ministry of Health and Long-Term Care has developed “Healthcare Action Plan ” which aims at increasing home and community care funding.

Considering the fact that 70% of home and community care in Ontario is provided by Personal Support Workers and Community Support Workers, there will be more jobs for these healthcare workers.

But due to attrition of existing workforce and multifold increase in the number of seniors requiring care, it will be hard to catch-up with the demand for PSW’s.

Due to above mentioned antagonistic forces, PSW’s are going to be in high demand but there won’t be enough of them to fulfill that demand.

This means only one thing: Personal Support Workers salary will go up.

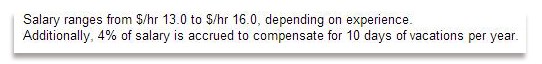

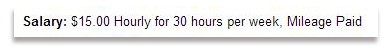

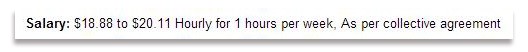

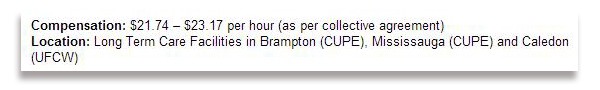

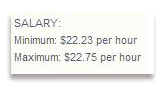

EXAMPLES OF PAY RATE

There is a wide array of pay scales for Personal Support Workers. Here are some of the examples of hourly pay offered by employers on Ontario. These snapshots have been taken from PSW job descriptions posted by various employees.

For facility-based care through employment agencies

For Home/Residential Care through employment agencies

Independent/Private Long-Term Care homes (Nursing homes)

City-owned Long-Term Care homes (Nursing homes)

Hospitals

If you’re not getting the enhanced salary from your employer, we would like to hear from you.

Provide your scenario in the comments section below. You don’t have to include any of your personal details or name the employer.

Resources you’ll need to become a Personal Support Worker

On this page, you can find anything there is to know about how to become a personal support worker, how to succeed as one, and how to continue your education. This is the place to come to and look for all the PSW resources and information that you may need on your journey as a Personal Support Worker.

PSW job interview questions

If you’re determined to pass your next PSW interview with flying colors, we’re here to help. PSWHQ have put together a thorough online guide with PSW interview questions and appropriate sample answers to these questions that hit the target, and are concise and supportive.

Performing well in the interview is just one part of many others needed to secure a PSW Job. First and foremost, you’ll need to have an impeccable résumé and cover letter in order to be called for an interview.

Guide to finding PSW jobs

After you have decided to become a Personal Support Worker and completed the course you are now at a point to start looking for work. It is important that you explore all the jobs listed under different job titles, which is why you should go through our ultimate guide to finding PSW jobs.

We also help you find PSW job postings from hospitals, long-term care homes, and community and private settings.

Advertising with PSWHQ

Over the past few years, PSWHQ has achieved a dominant ranking in major search engines such as Google and Bing. As a result, we offer a limited number of advertising opportunities to individuals, colleges, companies, and organizations we see as a good fit for the unique audience of PSWHQ.

If you found this article helpful, please consider sharing it!

FAQs

1. How much do PSW get paid in Ontario?

Housekeepers and other related occupations (NOC 4412) typically make between $13.46/hour and $23.08/hour in Canada, according to the Bureau of Labor Statistics. A personal support worker – home support is someone who provides home-based assistance to others.

2. Do PSW get pensions in Canada?

No, they are not eligible for pensions in Canada.

3. Is there a shortage of PSW in Ontario?

Currently, there is a shortage of PSWs. As a result of the pandemic, many workers have been displaced from their jobs, particularly in the hospitality and tourism industries.

4. How much does a PSW make in Quebec?

A PSW in Quebec makes an average of $19.50 per hour.

5. Is it hard being a PSW?

It is hard being a PSW because they are usually the first person to come in contact with any patients. This means that they have to be able to handle any situation that may arise, such as an emergency or difficult patient. They also need to be very knowledgeable about health care and medical terminology so that they can provide accurate information for the patient’s needs (such as medication instructions).

Great information!

It really helped me get some prospective on what PSW’s make.

Thanks.

Carrol, glad to know the information was helpful.

What is the average pay for a privately hired PSW in a home setting?

Thanks for your comment Bonnie.

For working in the community, PSW’s typically get paid anywhere upwards of $12.5/hour. This is the minimum. In general, it varies greatly and depends on many factors such as the employer and experience. Some employers compensate for travel while others don’t.

For Personal Support Workers who provide private care, the pay depends upon what has been negotiated between the family and the PSW.

There is a huge amount of disparity that exists between PSW’s working in the home care sector and those who work in hospitals and long-term care homes.

No mention on what wages should be on First Nation Reserves!!! I’ve been a psw for 5 yrs and no wage increases, except for COLA, of course. People are starting to realize that we should get a pay increase straight across the booad, not just the cities!!!!!!

St. Elizabeth of Thunder Bay claims they never received any govt. money and refuses to pay it’s employees the extra.

md, although Government promised $4 raise for PSWs last year over a three year old period however, it’s implementation has been marred with many problems.

Ministry of Health is aware of this situation and has acknowledged this. It is working on this issue to streamline the wage increase process.

I am currently a homecare psw in the Niagara region, when should we expect to see the $1.50 raise we have been given this year?

Is there a possibility that by April 2016, the base wage could be more than $16.50 for homecare psw workers or is that asking for too much?

Cortney, last year Liberal government had promised a $4 raise over a period of 3 years.

While the first phase of this raise ($1.50) was rolled out last year however there has been many issues related to that. Government is scrambling to fix all the issues related to the first raise and therefore have put the 2nd pay raise on hold for now.

As per the latest press release on this issue, Government plans to announce pay raise “very soon”.

Visit this section frequently to check for future updates.

Is there a cap on government raise, if you make over $16.50 will you still get the $1.50 raise?

Lynne, this is not something that is very clear yet.

Government is working on sorting everything out. That is why the $1.50 raise that was supposed to be rolled out on April 1st, has been postponed to August 1st, 2015.

Check out this page for future updates.

Hello,

My office mate told me yesterday that a PSW gets a salary of $20/hour right after graduation..i.e. no experience. Somehow I don’t believe it but he was pretty adamant that it is indeed the starting rate..

Just wondering what is going to happen to the pay rate after next years possible $1? Will we continue to get raises afterwards or just stay at the max of $19 for years to come?

I am working in retirement in Ottawa, but the company started in TO area. Our company in Ottawa has the first assisted living, and this where I do most of my work. Do you have any info regarding the wages for retirement. Thanks

Cheryl…PSW wages in retirement homes wary.

The “PSW Wage Enhancement” initiative by the Ministry of Health applies only to PSWs working in the community and providing LHIN funded care.

How do I know if my employer is publically funded in order to get paid $19.00.

Annabelle…just ask your employer. They should be able to tell you.

…Avtar

How do I know if my employer is part of LHIN? Would I receive $16.50/hr or $19.00/hr. Confused as to where I stand.

Annabelle…$16.50 per hour is the base pay if you work in the community and provide LHIN funded care.

$19 per hour is what you should get as part of the “PSW Wage Enhancement”.

You can question your employer whether they’re participating in the wage enhancement for PSWs.

…Avtar

Hello Avtar

I have a question on the wage enhancement. Im a registered PSW working in the community for a company I don’t need to name. The company works with LIHN and has been involved in the 4.00 Wage enhancement 2016…my question is:

How can I verify whether or not my company applied for the “PSW Wage Enhancement” of 19.00 ? Could I find out directly from another source LIHN ? … Im not sure I trust my company to reply ..When was this “PSW Wage Enhancement” effective.

will it be direct funding from LIHN ie topup of 3.50; 16.50 from company plus 3.50 “wage enhancement” from (LIHN). our pay was ie 12.92 plus 4.00 pay enhancement. then 14.00 base rate pay 2.92 wage enhancement…?? head office said it was an error should be reg pay of 16.92 …

Lynn…Agencies or organizations that provide Personal Support Services are listed by each LHIN. Organizations that deliver small volumes of services, or who are engaged infrequently, may not be listed.

These lists can be found on the website of each LHIN.

Wage enhancement is effective as of April 01, 2016.

It provides for all PSWs providing LHIN funded hours of Personal Support Services in Home and Community Care sector are eligible to receive the $1.00 wage increase up to a maximum of $19.00 per hour. PSWs earning

$19.00 per hour and above as of April 1, 2016, are not be eligible for the increase.

As per the ministry directives, PSWs eligible for this wage increase were to be provided with written notification of their new hourly wage rate by their employer by no later than July 1, 2016.

You should speak to your employer directly to determine your eligibility.

Avatar, I am a psw in Sudbury and gets $16.50 with 34 cents a km with no travel time. It’s difficult to get a decent pay and most of us quit to work at $14 so we can get more by working a 8 hour shift compared to driving around for 10 hours to make the same amount. My employer does get LHINs funding but just keeps hiring weekly. They’re now hiring at $1200 sign on bonus for PSWs and doing nothing to help me and the others who are struggling to stay at a job we love but can’t pay our bills on. Their only answer is put extra hours in because they have many clients to cover.

Stella, I hear you!

Personal Support is such a beautiful professional and there are many like you who love being a PSW and helping others.

Unfortunately, though, this profession lack oversight and as a result, many employment agencies cringe on their duty towards their employees.

The Government of Ontario has been trying to bring some sort of order to this profession albeit quite slowly.

PSW Registry of Ontario was launched recently but as you said, PSWs need much more than that!

Avatar, I am trying to understand the wage enhancement but having a hard time. I was with this company in 2017 and how they put it on my paystub is regular hours $15.46 and wage enhancement $1.04 to make it $16.50? Would this be correct?

Also what was happening I was constantly sent to places where no one was home and was told I could not get a full pay because it would not be fair to the llyn but I found my paystubs to have more of the $1.04 hours pay than my regular pay at $15.46 and when confronted they now only show my pay as regular at 16.50 without wage enhancement so I cannot see their mistakes. What can I do about this?

My pays are $700 every 2 weeks and hard to live on

I work in a community hospital full time and make a little less than the minimum wage of 22.23

Hello,

How exactly does the “PSW Wage Enhancement” work? The company I work for states they gave us the base wage increase to $16.50 but that is all they have to do. They say no where does it state that there is a top up to bring our wage to $19 yet I have seen pay stubs from other companies that have “wage enhancement” on it.

Does the wage enhancement mean that if my base wage is $16.50 the “wage enhancement” would top up $2.50 to total $19??? If so who pays the top up and how does my company get the funding??

Is there a contact person the company I work for could call for more information?

Thank you

Kim…$16.50 is the base pay for PSWs working in the community and providing direct patient care.

Wage enhancement up to $19 per hour is an extension of the “PSW wage enhancement” initiative which is part of the Government’s “PSW workforce stabilization strategy”.

All PSWs providing publically funded personal support services in the home and community care are eligible for this enhancement of up to $19 per hour.

The Ministry of Health and Long-Term Care provide funding to the local LHINs which in turn support the agencies(service providers) to implement the wage enhancement.

Please note that the ministry mandates a $1.00 wage increase up to a maximum of $19 per hour for PSWs providing direct care in the home and community care settings. This is explained in the article above.

In a nutshell, if you’re getting the base pay of $16.50 per hour, you should be getting a $1 per hour increase under the following circumstances:

If you provide services that are not “Personal Support Services”, you’ll not be eligible for this $1 raise on top of the $16.50 base pay.

Thank you for the information.

No problem Kim.

You can check out the article above to see which are considered as “Personal Support Services” in the community and what services do not qualify for the wage enhancement.

Hi Avtar

Any recommendations as to whom I could contact to clarify exactly how much I should be getting paid? I would forward the information to the company I work for as they are adamant that the $16.50 base pay they are currently giving us since April 2016 is all that the PSW wage enhancement is. We definitely provide LHIN funded personal support services as on my hours on my pay stubs are under CCAC when we see clients.

Thank you

Kim

Kim…the Ministry of Health and Long-term care issued a “Directive Addendum” back in 2016 regarding the $1.00 raise on top of the base pay of $16.50.

Mandatory requirements under the addendum are:

Sets a minimum base wage of $16.50 per hour for individuals providing LHIN funded personal support services.

Requires an hourly wage increase of $1.00 per hour up to a maximum of $19.00 per hour for individuals providing LHIN funded personal support services retroactive to April 01, 2016.

Requires employers to maintain hourly wage increases established in the Directive for the duration of that individual’s employment.

This 2016 Directive Addendum only applies to direct hours of work providing LHIN funded personal support services and does not apply to indirect hours of work (e.g. sick time, training time, travel time).

You can download the complete document here.

Hope the Ministry issues document will provide clarify this further.

Let me know if you have any further questions.

Hello,

I was an unlicensed Personal Home Care Aide (Statistics Canada NOC 4412 title code) for my parent between 2005 through to 2015 providing 24/7 Live-In Care. I have performed an exhaustive search for the Annual Salary figures for my profession using the Statistics Canada website to no avail. Since I did not possess the formal PSW Training, should I use the respective Toronto minimum-wage to calculate my respective annual salary for each year that I cared for my father ? Do I assume the standard 12-hour shift per day ? I live in Toronto, Ontario. Do you have access to the Annual Salaries of unlicensed Personal Home Care Aides in Ontario ? Toronto ? If so, please provide this link. I am trying to value my time as I did not work for a PSW Agency as i personally sacrificed my career to take care of my ailing parent. My annual taxable income always had an empty value for Line 104 (employment income) on the T1 returns because I dedicated my time to the ailing parent. Thus, what is the opportunity cost of my time for taking care of my ailing parent ? MINIMUM WAGE assuming 12-hour shift per day ? Thank You !

FlatBroke…thank you for your question.

I would suggest you discuss your situation with an accountant.

They can help you figure this out.

2nd Part, cont’d….. How do you value the below services to an ailing parent ? I was an unlicensed Personal Home Care Aide for 10 years. Minimum wage at 12-hr shift per day ? If the below services are not considered Personal Support Services, what are they ? Taking care of my dying parent was a FULL-TIME JOB to which I never received compensation. I sacrificed my career, marriage, and have no pension. Do you have any financial figures that you could post or send to me in a private e-mail to financially value my time ? I did everything that a PSW did as well as the below functions. Thanks !

As per the Home Care and Community Services act, 1994, following are not considered Personal Support Services:

1. Housecleaning

2. Doing laundry

3. Ironing

4. Mending

5. Shopping

6. Banking

7. Paying bills

8. Planning menus

9. Preparing meals

10. Caring for children

11. Assisting a person with any of the activities mentioned above

12. Training a person to carry out or assist with any of the activities mentioned above

13. Providing prescribed equipment, supplies or other goods.

14. Services prescribed as homemaking services

I am a Self-Manager with the Direct Funding Program with CILT and they include these as Personal Support Services as I am responsible for directing my care. I am a quadriplegic and can’t do many of these things. These are some of the reasons why I need my staff, so this is Real Personal Care. Everyone is paid, respected and treated fairly… Just like I expect to be!

I work for a company that cares for disabled persons in an independent living program.

We are called Support Service Attendants. Along with the regular PSW duties, we are highly trained by nurses to provide medical services to our clients, including:

digital stim, bladder irrigation, insulin injections, medication administration, trach suctioning, as well as range of motion exercises. My question is, because we do actual nursing duties, why is it that we only get paid the same as other PSW’s that are not required to perform these routines?

Kathy…thank you for your comment. It brings forward an issue that is always at the epicenter of the career as a Personal Support Worker.

PSW salaries are primarily established by the employer you’re working for or if you’re working in a unionized setting, such as a hospital or a nursing home, the salaries are mandated by the contract the union negotiates with the employer.

As in your case, the employer seems to be mandating the salary based on the type of duties you perform.

Have there been any plans to reassess the $19.00 cap? So far it has not even been increased by cost of living. So, despite receiving hours of service raises, as well as company wide increases, my net has stayed the same for years. I get a $1.00 raise From my employer, the MOH just reduces the same amount in my wage enhancement. Seems very short sighted.

I’m a community psw working for a very well known company that only pays new psws a base 14.57 and the wage enhancement brings it to 16.50. I thought that the minimum base is supposed to be 16.50?

Any time we have a base wage increase they take the money off of the wage enhancement so that I’m still making 16.50. I’ve been with this company since beginning of 2018 and I worked for them in 2016 for a short time and they paid $19 then.

I don’t understand why people that were hired in 2016 make 2.50 an hour more than one hired in 2018. I’m never going to make as much as the other psws and I’m working for the same company doing the exact same work.

First, why do they get away with such a low base pay if it’s supposed to be 16.50? Second, where is my wage enhancement going if I’m not getting it? This company has been in union negotiations since March 2019, they refuse to pay more than they are. I know there are other companies that pay more but I do really love my job and care about the people I see every day and I don’t want to have to start all over again and I shouldn’t have to. They should be paying us the same as they are paying the other psws.

I am a PSW funded by the LHIN working in homecare. Upon my hire in October 1018 I was making a base wage of$14.57 an hour with a government grant of $1.93 an hour to bring my wage to $16.50. I just received a base wage increase of 0.29 an hour bringing my base wage to $14.86 an hour, but my government grant also decreased the same amount of 0.29 an hour, going from $1.93 down to $1.64, which still leaves me at a total of $16.50 an hour. I thought my base wage was supposed to be $16.50 an hour BEFORE the government grant?

Who governs the agencies to make sure they are paying the proper wages to their employees? I started working with an agency back in 05, 2016, my start rate should have already been 17.50 per hour but I was paid $16. Then it went up to $17 per hour on 09/16. It stayed at that rate until 07/19. I’m I not owed back pay for all those hours I was shorted? Who do we contact to have this settled. Thanks for your time June.

We PSWs do NOT get paid enough for the work we do. How do we petition for high pay?

can my employer cut back my psw hours so that I am not working overtime? he want me to work only 8 hour not 12, so i lose overtime .

Hi Dolly,

Employers usually adjust assigned shifts and working hours as per the needs of the organization and are often according to the organizational policy and/or union contracts. It is best to check with your employer or the union(if applicable).

Avtar

Some serious investigation needs to be done into PSW pay here in Ontario and across the country. My niece, age 20 graduated the PSW course in 2020. Her first job at a retirement home paid $14 hr, she quit when she got a job in a hospital at a starting rate of $24 hr. Plus benefits which include paid sick days and a pension plan.

My daughter, single, age 46 has been a PSW for 20 years and works with a company that does community care and caps the PSW wage at $19 no matter how long they have worked at the company or how experienced they are. If she gets sick, too bad. No work no pay. She does get a small health benefit that helps pay for medication. But considering she has to be out in all kinds of weather and must drive a reliable vehicle there is a good case for looking at the fairness in the way these PSWs are paid.

Yes she could quit and go to a hospital but where would that leave people in the community that need help.

Is it surprising that a good number of PSWs quit during their first year after qualifying?

Retirement homes do not get government funding like the Hospital does. There is no funding for private type care. That makes a huge difference, because the funds come from the pocket of the owner of the business. I pride myself as a private provider, but my region can only pay so much for the services, I would love to pay my staff $24/hr, but cannot do that without loosing my business. JMHO